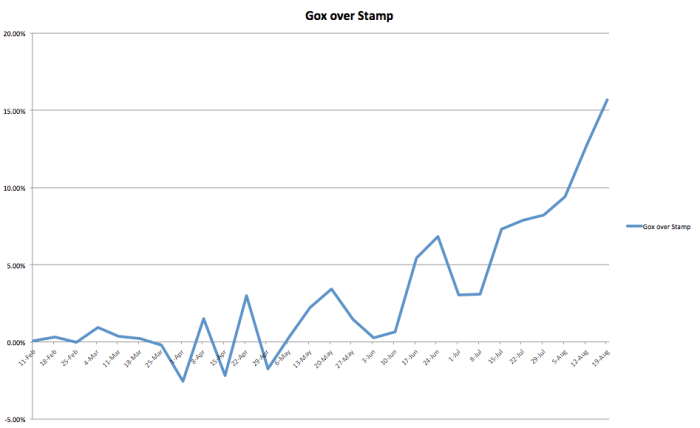

A banking risk premium: Mt. Gox XBT/USD spread over Bitstamp

/The US dollar (USD) price of Bitcoin (XBT) on the Mt. Gox exchange has been rising steadily, but it has also been rising at rates far out of proportion to rallies at competing exchanges. It appears from various commentators and reports that the primary factor in this divergence may be difficulties and perceived risks users face in withdrawing USD from Mt. Gox (see for example, the recent post at Bitscan and this Reddit thread). George McHugh cited a recent wave of regulatory uncertainties in the United States in this connection. This includes the seizure (without warning, for a paperwork issue) earlier this year of US bank accounts associated with Mt. Gox business containing $2.9mn.

The following chart appears to illustrate this story by showing the gradually and then dramatically rising percentage spread between Mt. Gox and Bitstamp, the second largest Bitcoin exchange by volume, over the past six months (weekly weighted average data from Bitcoincharts).

According to user reports, whereas Bitstamp reliably and promptly processes both deposits and withdrawals of fiat currencies, Mt. Gox’s ability to do so, particularly with regard to US dollars, has become highly unreliable in the eyes of more and more market participants. The most reliable way to remove value from Mt. Gox is therefore perceived to be buying Bitcoin and withdrawing it, a simple, quick and fee-free procedure. This generates an on-exchange premium for Bitcoin and a steep discount for dollars due to the perceived relative risks and costs of taking delivery of the latter.

In well-functioning markets, such spreads would be crushed and equalized in short order through arbitrage actions. However, the general difficulties of using high-cost, slow and barely interoperable legacy banking systems across borders, as well as the perceived difficulties and risks at the Mt. Gox business in particular are combining to undermine otherwise glaring arbitrage opportunities. In contrast, the movement of XBT from one exchange to another is trivial—effectively costless, instantaneous and location-independent.