Short-term Bitcoin exchange trends as Rorschach tests of economic views

/

I try to stay at least 98% positive in general; critique can be more tempting than contribution. That said, sometimes understanding can be advanced by considering contrasting examples. Here are three.

Realized/unrealized gains/losses

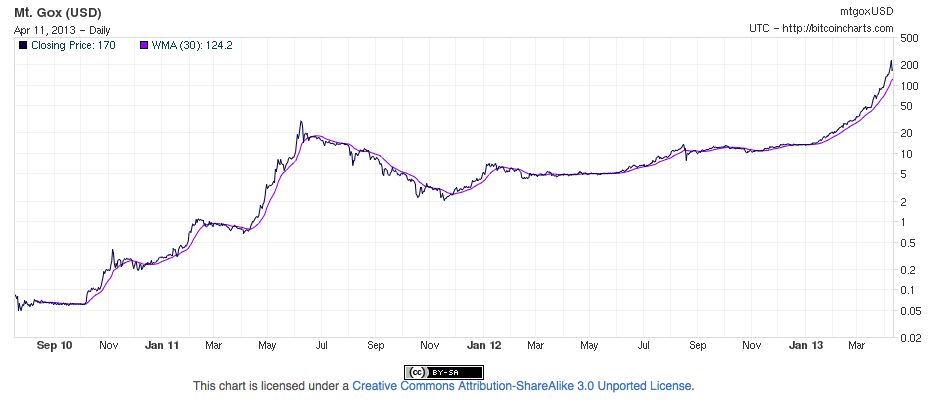

First, it appears that the distinction between realized and unrealized gains and losses could be kept more firmly in mind by most. The take-home point is that for all those Bitcoin market participants (whether bull or bear) who did not actually trade today or recently, nothing much actually happened during the rapid headline price changes on the exchanges (of course, the changes might lead some to adjust their future plans according to their various forward-looking judgments). What these exchange prices actually indicate is merely the current record of transactions that are occurring on those exchanges. It is only the collection of such discrete “real time” recorded exchange events that provide the data for the construction of the lines on the trend graphs.

At times of temporary disruption of access to websites, low visibility prevails. Pre-placed automated orders execute and panicking short-termers flee. The price graphs (as they become accessible after the disruption) show the actual trades and volumes at particular times during this course of events. The price graph on a given exchange indicates actual marginal activity, at given moments, on that exchange. These exchange services are specific businesses; not magical, instant oracles of “price” in general or “value” in general. In the event, the top two exchanges, it appears from preliminary reports, were most likely under active manipulation in a possibly partly orchestrated move (and do not forget that this may well have included both upward and downward elements).

What a difference a few days can make.

What a difference a few days can make.

A spiral into absurdity

Second, the good old “deflationary spiral” fallacy (maybe market observers will get a couple days off from hearing that one now?) apparently misses the significance of the fact that BOTH a buyer and a seller are required to form any given data input for market price graphs. With no transactions occurring, which is what is posited in this imaginary world of “no one will sell when it is so valuable,” there is no “price” at all. Thus, the market “price” could not be too high, because it would be non-existent under the stated assumption that no transactions were occurring. Reductio ad absurdum. These exchange prices form an up-to-date historical record at a given time of actual recent buying and selling on a given exchange.

Look for the verb

Finally, it has been a little surprising just how many Bitcoin critics employ the concept of “intrinsic value” in making the claim that Bitcoin does not have any. It was members of the Austrian school of economics, with the so-called subjectivist marginal revolution, that had seemingly put the final nail in the coffin of this ancient economic fallacy. Beginning in the 1870s, Austrian school scholars began to re-emphasize the view that value is ultimately the result of valuation, in reference to the verb to value, which is an act that can only be performed by living people (We now understand that some of the Late Scholastics of Salamanca also had this point reasonably clear several centuries earlier). After Carl Menger, this view gained steam with Eugen Böhm-Bawerk and unmistakable clarity with Ludwig von Mises’s 1912 Theory of Money and Credit and later works. This further application of the subjective theory of value clarified that the concept of “intrinsic value” is ultimately incoherent, not only with regard to goods in general, but to media of exchange as well. Mises was rather strict on this point in TMC, pp. 61–62:

Our terminology should [help to overcome] the naive and confused popular conception of value that sees in the precious metals something “intrinsically” valuable and in paper credit money something necessarily anomalous. Scientifically, this terminology is perfectly useless and a source of endless misunderstanding and misrepresentation.

Note: I discuss value theory in simple terms with illustrative examples in Resolving the paradox of valueFor a more detailed discussion, see IN-DEPTH | The sound of one bitcoin: Tangibility, scarcity, and a “hard-money” checklist.